Stock Market

The ability to accurately investigate and interpret market facts is crucial for fulfilment in the ever-changing world of buying and selling. Traders use a range of tools to make perfect decisions, and indicators are an essential part of their technique. We will look at the best buying and selling signs in this extensive book, giving you the ability to accurately and confidently navigate the markets.

Moving Averages:

Fundamental indicators such as moving averages filter out charging information to provide a more lucid picture of the overall trend. Both the Exponential Moving Average (EMA) and the Simple Moving Average (SMA) are frequently utilized. While SMAs offer a trustworthy cost average, EMAs place a higher value on current expenses, making them more susceptible to market fluctuations.

Relative Strength Index (RSI):

The rate and alternate rate actions are measured by the RSI, a momentum oscillator. Readings above 70 indicate overbought conditions, while readings below 30 indicate oversold conditions. The RSI values range from zero to one hundred. RSI is used by traders to identify reversals in capacity trends and produce buy or sell recommendations.

Moving Average Convergence Divergence (MACD):

The MACD is a flexible indicator that combines elements of momentum and fashion-following indicators. It has both a signal line and a MACD line. A bullish sign is produced when the MACD line crosses above the sign line, and vice additionally, by focusing on the difference between the MACD and the signal line, the MACD graph offers details regarding the strength of a trend.

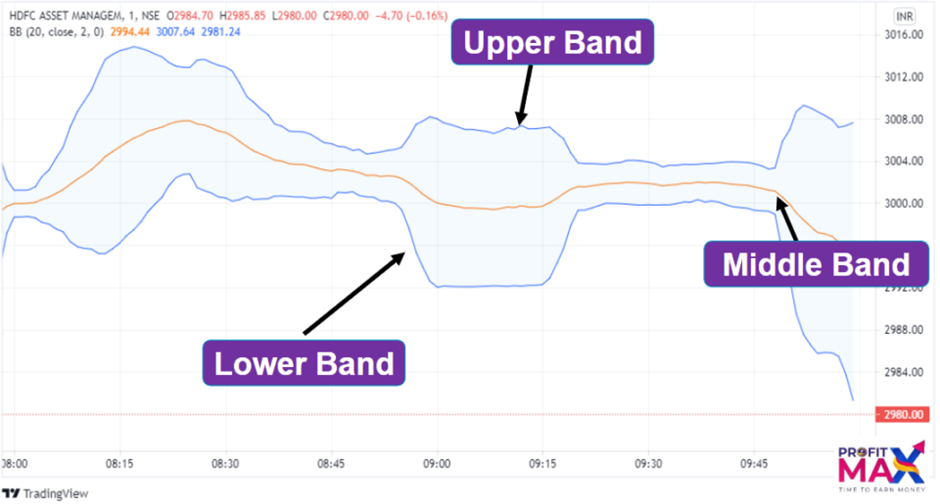

The top and lower bands of a Bollinger Band indicate N well-known departures from the moving average, while the center band is an N-length easy transferable average. Depending on the volatility of the market, the bands stretch and agree. To identify potential reversal or continuation indicators, traders usually look for fee touches around the bands.

Fibonacci Retracement:

The mathematical relationships seen in nature serve as the foundation for the Fibonacci retracement stages. These levels are used by traders to spot possible market reversals. The important Fibonacci numbers are 23.6%, 38.2%, 50%, and 61%.78.6% and 8%. Fibonacci retracements enhance the accuracy of access and exit points when used with other indicators.

Stochastic Oscillator:

Over a given period, the Stochastic Oscillator compares the ultimate fee of protection to its rate variety. It produces numbers between 0 to 100, where readings below 20 indicate oversold conditions and readings above 80 indicate overbought ones. Crossovers and divergence of stochastic oscillators are frequently used by traders to spot capability trend reversals.

Ichimoku Cloud:

The Ichimoku Cloud is a comprehensive indicator that offers information on momentum, trend direction, and assist and resistance levels. Tenkan-sen, Kijun-sen, Senkou Span A and B, and the Chikou Span are the five traces that are included. To make wise trading decisions, traders examine how such traces interact with one another.

Average True Range (ATR):

By examining the typical range between high and sporadic charges over a specific time period, ATR calculates marketplace volatility. ATR is used by traders to establish stop-loss ranges, which are largely modified in response to current market conditions. Improved volatility is indicated by higher ATR values.

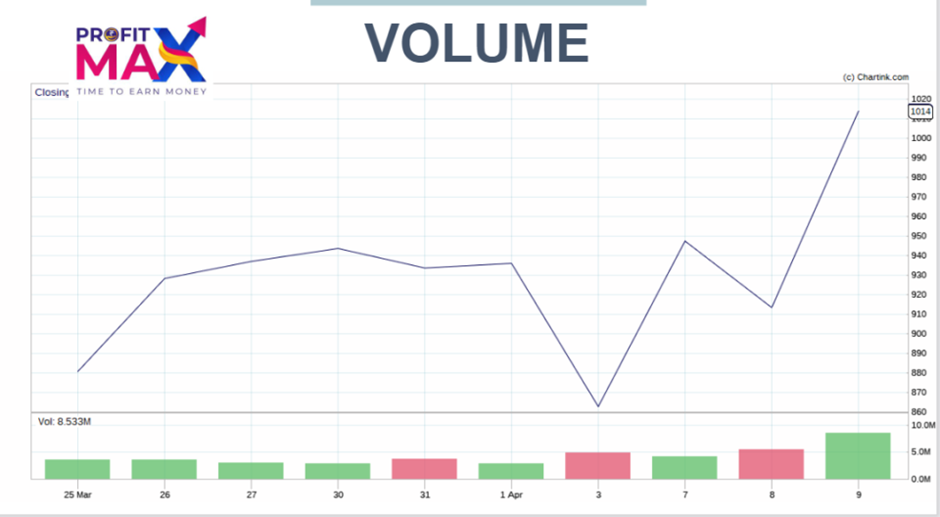

Volume:

Technical analysis relies heavily on purchasing and selling amount, even if it is no longer a stand-alone indicator. Volume validates a trend’s strength or shows capacity reversals. Investors might learn a lot from the sudden surges in quantity that frequently accompany huge rate actions.

Parabolic SAR:

Being aware of capacity reversals inside the marketplace is made possible by the Parabolic SAR (Stop and Reverse) indicator. The fashion’s path is shown by dots that appear above or below rate bars. The dots indicate a reversal of ability when they change facets.

Conclusion:

Using the power of these indicators in tandem with a well-outlined strategy is essential to becoming an expert trader. Even while each indicator provides accurate information, combining them might provide a more comprehensive understanding of market dynamics. Which can help you make the most money when trading long-term or intraday (including buying and selling futures and options).

It’s critical to comprehend each indicator’s advantages and disadvantages and modify them to fit your trading style. As you set out on your trading journey, remember that indicators are tools and that the thoughtful and methodical use of those tools in constantly shifting market conditions is what will determine your success.

While using these indicators you have to keep in mind which indicator will work efficiently in which time frame some indicators work for long-term trading however some indicators work for intraday and long-term as well. In this case, we have several tested strategies that work differently for intraday, and long term using this strategy you can observe a success ratio of 80% or more.

You can reach out to us at +91-7722082020 | Email: info@profitmaxacademy.com

Moreover, we provide consultation free of cost it’s just a WhatsApp away.

You can also follow us on social media for regular updates related to the stock market.