Introduction about Stock Market Trading:

The stock marketplace, with its ebbs and flows, complexities, and capacity for wealth creation, has intrigued investors and lovers for many years. For the ones keen to navigate the markets and understand the nuances of inventory trading, there may be a treasure trove of expertise waiting within the pages of some super books on Stock Market Trading. In this guide, we embark on a literary adventure to discover the great books on the stock market Trading, imparting insights, techniques, and undying wisdom.

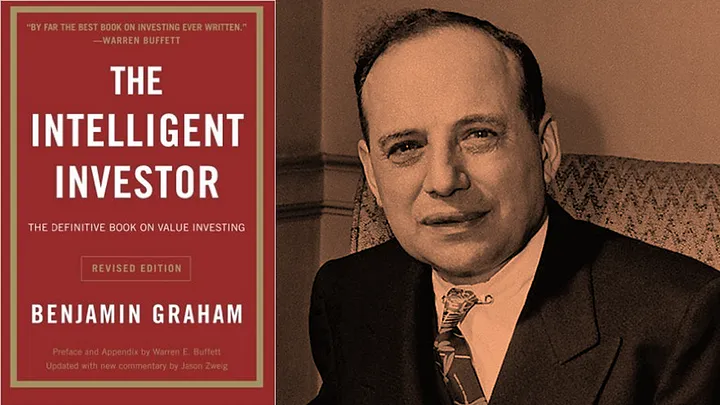

1. The Intelligent Investor by using Benjamin Graham

Published in 1949, Benjamin Graham’s The Intelligent Investor is often considered the Bible of price investing. Graham, a mentor to Warren Buffett, imparts timeless concepts, emphasizing the importance of a rational and disciplined technique to investing. The e-book guides readers via the ideas of intrinsic cost, margin of safety, and the psychology of the marketplace, making it an integral study for each beginners and pro investors.

2. A Random Walk Down Wall Street by way of Burton Malkiel

Burton Malkiel’s traditional A Random Walk Down Wall Street is a need to-read for every person looking for a comprehensive overview of different funding techniques. Malkiel explores the efficient market hypothesis and advocates for a passive, index-fund-based method to making an investment. The ebook covers more than a few topics, from technical evaluation to behavioral finance, providing readers with a properly-rounded understanding of marketplace dynamics.

3. Common Stocks and Uncommon Profits by means of Philip Fisher

First posted in 1958, Philip Fisher’s; Common Stocks and Uncommon Profits specializes in long-term funding techniques. Fisher emphasizes the importance of know-how a company’s qualitative aspects, together with management satisfactory and competitive advantages. The ebook’s enduring relevance lies in Fisher’s insightful investment ideas and his emphasis at the qualitative factors of inventory selection.

4. One Up On Wall Street by Peter Lynch

Legendary fund supervisor Peter Lynch stocks his investment philosophy and techniques in One Up On Wall Street. Lynch advocates for the purchase what method and encourages buyers to accept as true with their instincts. The book affords realistic insights into figuring out multibagger shares and navigating the dynamic world of the stock market.

5. Market Wizards with the aid of Jack D. Schwager

Market Wizards with the aid of Jack D. Schwager gives a charming glimpse into the minds of a success investors. Schwager interviews pinnacle investors, extracting their trading philosophies and techniques. The ebook highlights the diversity of procedures amongst a success buyers and presents valuable classes for readers seeking to hone their trading abilities

6. Reminiscences of a Stock Operator by way of Edwin Lefèvre

Reminiscences of a Stock Operator & quot; is a fictionalized biography of Jesse Livermore, one of the most well-known investors of the early twentieth century. Written by using Edwin Lefèvre, the e book captures Livermore’s reviews, successes, and failures within the stock market. The narrative fashion makes complex market standards available, offering undying instructions on speculation and marketplace psychology.

7. Flash Boys by Michael Lewis

Michael Lewis’s; Flash Boys; delves into the sector of excessive-frequency trading and the impact of generation on the stock market. The e book explores the rise of digital buying and selling structures and the quest for milliseconds in executing trades. Flash Boys sheds light on the intricacies of modern markets and the demanding situations faced via individual investors.

8. The Little Book That Still Beats the Market via Joel Greenblatt

Joel Greenblatt’s The Little Book That Still Beats the Market introduces readers to the magic method for investing. Greenblatt outlines a straightforward technique to fee investing, focusing on buying appropriate groups at good buy prices. The e book simplifies complex standards, making it handy to buyers at numerous enjoy levels.

9. Technical Analysis of the Financial Markets with the aid of John J. Murphy

For the ones interested by technical analysis, John J. Murphy’s Technical Analysis of the Financial Markets is a complete guide. Murphy covers chart styles, indicators, and technical trading techniques. The e book serves as a treasured resource for know-how the visual illustration of marketplace developments and making informed buying and selling selections.

10. The Essays of Warren Buffett by using Warren Buffett and Lawrence Cunningham

Compiled by using Lawrence Cunningham, The Essays of Warren Buffett brings together the once a year letters to shareholders written via Warren Buffett. The series presents insights into Buffett’s investment philosophy, commercial enterprise standards, and his approach to managing Berkshire Hathaway. Reading Buffett’s letters gives a masterclass in lengthy-time period fee investing.

Conclusion: Knowledge because the Ultimate Investment

In the sector of inventory stock markets, wherein uncertainty is regular and change is inevitable, the information contained in those books serves as a guiding mild. Each author brings a unique perspective, allowing readers to increase their funding philosophies and techniques. Whether you are a newbie investor or a seasoned dealer, the knowledge gleaned from these books can empower you to navigate the complexities of the inventory marketplace with confidence and informed selection-making. Happy reading, and may your investments be ever rich.